Axway solutions for the banking and financial services industry

Modernize legacy systems, protect financial data, meet regulations, and build the experiences customers want with scalable enterprise integration solutions tuned to the financial sector.

Axway banking and financial solutions are trusted by

3 of 4

major credit card firms

6 in 10

of the world's largest banks

40%

of daily U.S. GDP

Enterprise integration solutions invested in your success

Axway MFT, B2Bi, API management, and open banking for financial firms accelerate innovation and go-to-market strategy, enhance security, and streamline collaboration with fintech partners.

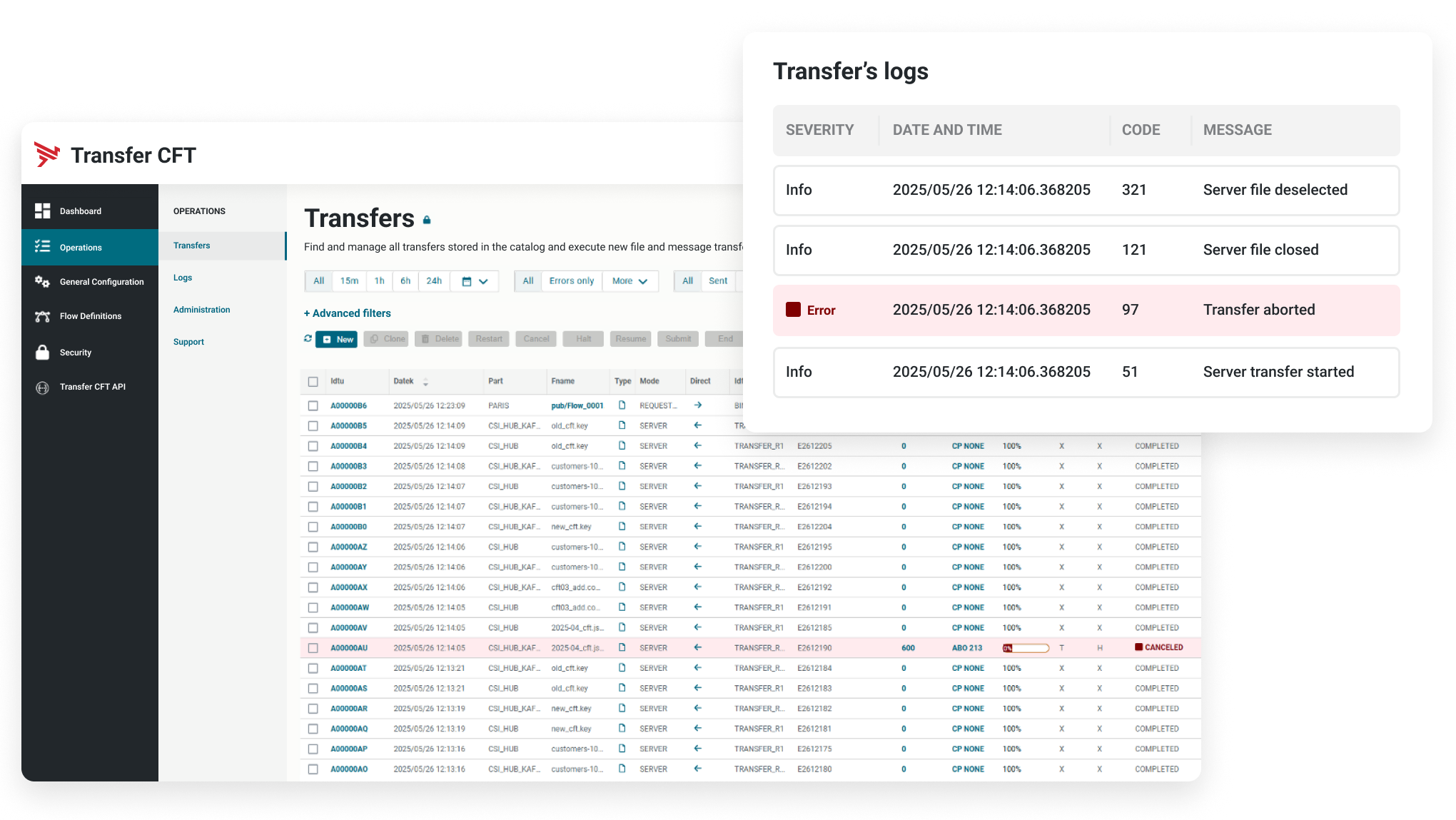

Keep your data moving between systems and partners

The world has high expectations of the banking and financial services industry. The transactions and services this industry provides are relied upon in a way which means any delay or disruption is unacceptable. Axway’s managed file transfer is not just built to move files between locations; it is built for security, compliance, flexibility, and resilience. Banks and financial service institutions can always depend on Axway MFT.

Strengthen partner networks and operational agility

Axway B2B/EDI Integration ensures uninterrupted data exchange and compliance with SWIFT, PCI, DSS, and other standards. Partner connectivity and message tracking through direct EDI or Axway's VAN, multi-clustering, containerization, advanced mapping and orchestration, and support for all major EDI protocols and formats, enhance operational agility. AI simplifies B2B operations, cuts manual effort, and promotes a competitive advantage.

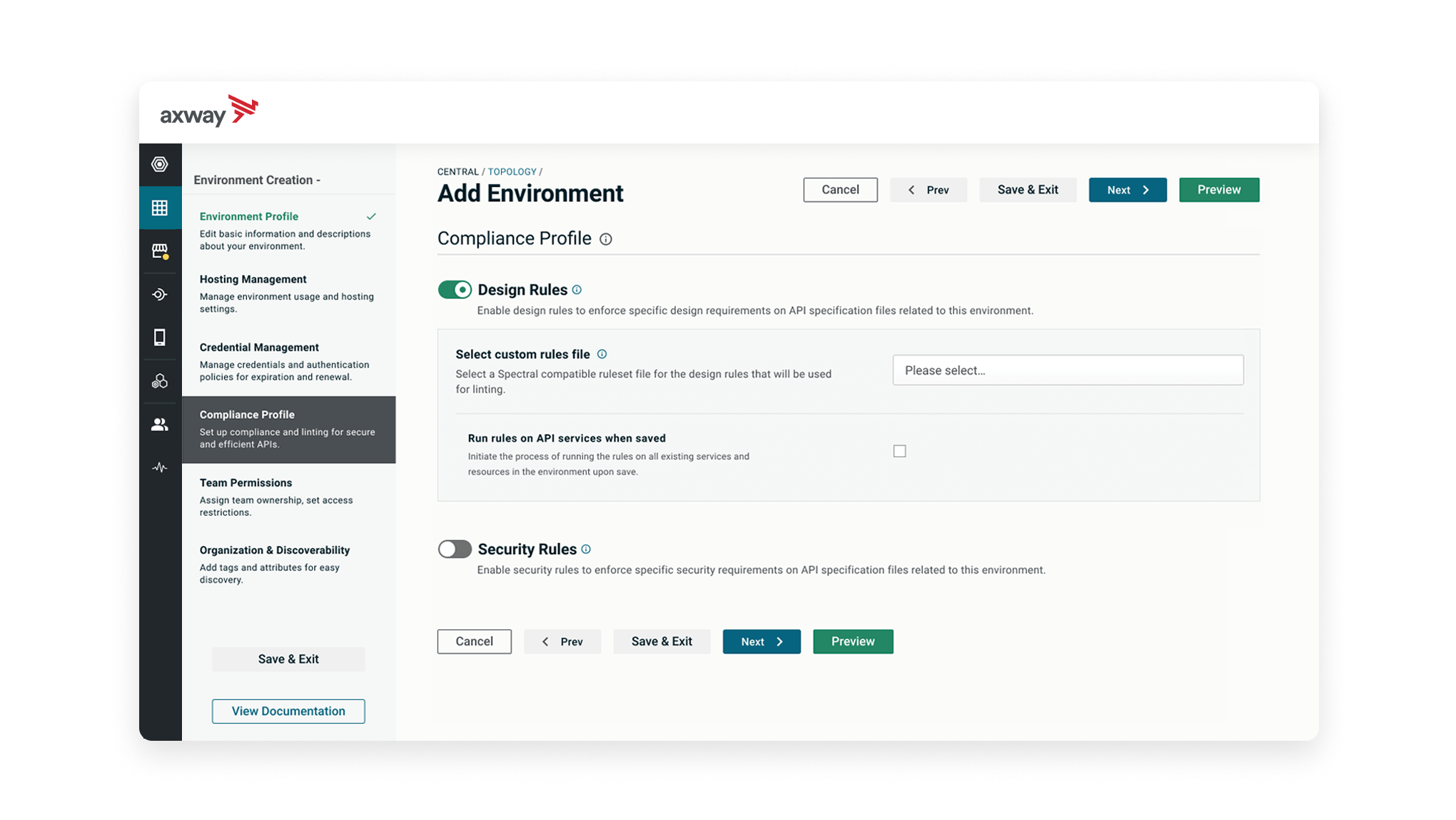

Monetize APIs, drive adoption, and leverage AI

The Amplify API Management Platform empowers financial institutions to securely scale open banking and promote fintech partnerships. Centralized governance, analytics, and policy enforcement enable adherence to PSD2, CDR, and FDX regulations. Connect data and systems across apps for real-time, event-driven experiences. Drive adoption and monetization in a branded API marketplace and adopt AI for fraud prevention and risk modeling.

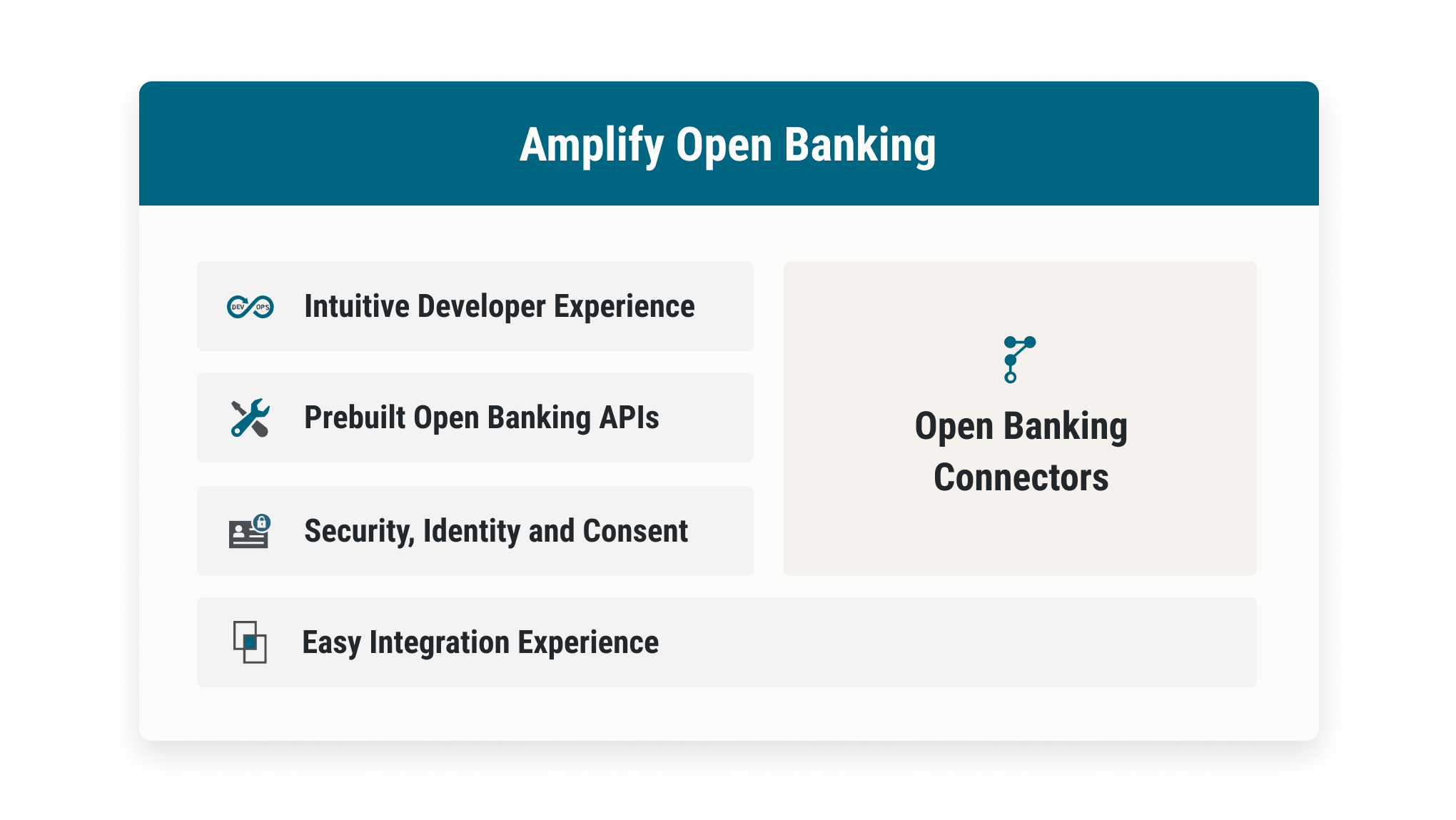

Build experiences financial consumers and developers want

Amplify Open Banking allows financial institutions to share data securely, innovate confidently, and create consumer experiences that stimulate business growth. An intuitive developer experience offers seamless third-party onboarding and management. Prebuilt open banking (FDX) APIs ensure security and compliance with evolving regulations. And scalable consent management offers strict data protection and access control as needs change.

Outperforming other banking and financial services solutions

Axway’s solution capabilities are uniquely aligned with the banking and financial services industry, offering a blend of modern agility and legacy reliability that few others can match.

Regulatory-grade data integration

Reusable compliance-ready integration with core banking and third parties with little to no code.

Multi-protocol integration across ecosystems

Support for unified legacy and modern protocols that surpasses competitor offerings focused only on APIs or iPaaS.

Secure, scalable managed file transfer

Battle-tested MFT that is best suited to financial-grade workloads, unlike lightweight, cloud-only solutions.

Multi-platform and OS flexibility

Supports an array of platforms and operating systems for financial firms that depend on legacy systems for file and data transfer.

Payment file exchange standards compliance

Seamless payment exchange between banks and corporations, interbank transactions, and real-time payments via EBICS.

Secure file transfer client

Secure and direct connectivity with partners, suppliers, customers and employees quickly, efficiently, and reliably.

Trusted B2B/EDI integration

Direct EDI, VAN, API-connectivity and B2B compliance features that competitors often lack and therefore require third-party tools.

MFT and B2Bi managed cloud services

Securely migrate B2B/EDI or MFT operations to the cloud by delegating all or some operations to the experts at Axway.

Open banking enablement

Modular open banking accelerators that complement existing infrastructure, rather than replace it.

Open API support

Integration via standard, open APIs and patterns such as GraphQL and gRPC. Support adoption of headless applications for agentic AI.

Solid banking and financial services pedigree

Unique strengths originated with Sopra Steria (now SBS), currently leveraging synergies as independent companies under 74Software.

We're a recognized industry leader

When you need to validate your digital integration product decisions, look to see what the most respected industry analysts are saying.

10 times a Leader

2025 marks the 10th time Axway has been named a Leader in the Gartner® Magic Quadrant™ for API Management.

Named a Leader in IDC MarketScape report

Axway has been named as a Leader in the IDC MarketScape: Worldwide Business-to-Business Middleware 2024 Vendor Assessment.

Named a leader in G2 reports

For the tenth consecutive time, Axway was named a leader in the G2 Winter 2025 reports for our three main product lines: Amplify API Management Platform, Managed File Transfer, and B2B Integration.

Leading companies trust Axway Banking and Financial solutions

Enterprise integration excellence is a tap away

Axway experts are standing by to learn about your enterprise integration strategy and goals and offer the banking and financial services solutions that will help you achieve them.