Key benefits of Financial Accounting Hub

Accelerate digital finance transformation by reducing finance information system complexity.

Operational excellence

- Close books in two days, not weeks – no need to spend nights on closing books

- Automatically process 10 million transactions in 10 minutes for real-time inventory and customer positions

- Automatically generate consistent postings in multi-GAAPs

- Reconcile inventory and accounting automatically every morning instead of waiting until the end of the month

Business agility

- Integrate an acquired company quickly (within 9 months for one global bank)

- Master complexity and consolidate feeds from more than 150 back-office systems into one system

- Respond faster to business changes by setting up one new business flow in one week, not 4 months

- Cut integration project load in half when migrating to a new ERP system

Data reliability

- Add reporting segments to automatically feed business dashboards

- Automatically reconcile business data with accounting data

- Reduce rejects from the ERP and fix errors

- Monitor data ingestion in ERP through dashboards

- Expose trusted data

- Navigate actionable audit trails

One Solution for Many Projects: An Agnostic Approach

Compliance

Easily deploy and enforce accounting standards and regulations. Track everything and respond to internal or regulatory audits without delay.

Consolidation

Quickly integrate financial information systems to pilot a new business entity faster. Manage and report across multiple legal entities and automate processes inside and outside the company.

Cloud migration and ERP rationalization

Decrease costs, risks, delays and increase data quality when converging existing systems to an up-to-date Financial Management System or a new core model.

Finance transformation

Increase automation and efficiency, leverage sourced financial data, and build trust.

Integrate functionalities of new components cloud-based or on premise using real-time events and APIs.

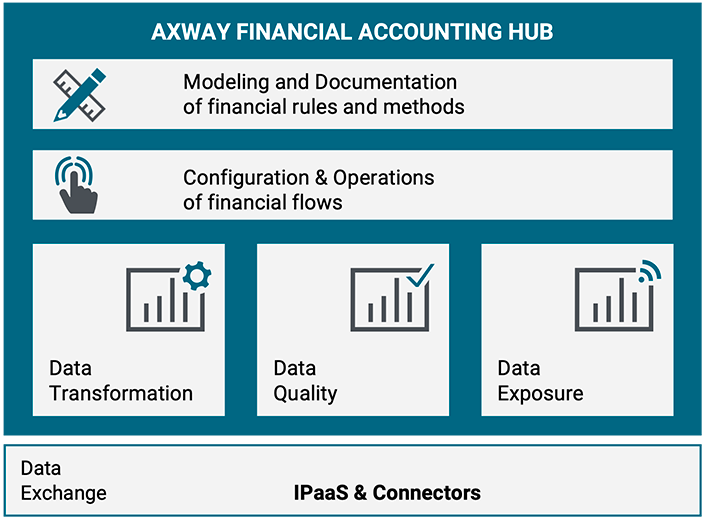

AFAH core functions

- Enables control of financial data by the Financial Department

- Ensures quality, traceability, and justification of data processing

- Simplifies connectivity with different data producers and consumers

- Transforms data based on accounting rules

- Provides audit and data recycling tools

- Offers services for configuring and supervising financial and accounting data flows

New Modeling and Documentation of Accounting Rules and Methods Service

Learn More

Companies using Financial Accounting Hub

Cut the cost of compliance and gain business agility

AUXIA automatically processes and delivers financial data in the formats its clients and regulators require and can update formats by simply changing business rules — helping to strengthen client relationships, ensure compliance, and contain costs.

Processing tens of millions of business events every day

BNP Paribas adapts accounting systems while providing an increasingly wider and more detailed spectrum of information to stakeholders, both internal and external, in a constantly evolving environment.

Scaling data volumes and boosting processing speeds

La Poste optimizes its accounting information system for improved performance and standards-based processes, while distributing control of business rules and processes to functional players.

Gain in business agility

With greater business agility, ODDO BHF can launch a new product very quickly since it only takes two to four weeks to make the necessary accounting adjustments.

AFAH ecosystem